VA Health Benefits and Medicare Part B: A Critical Guide

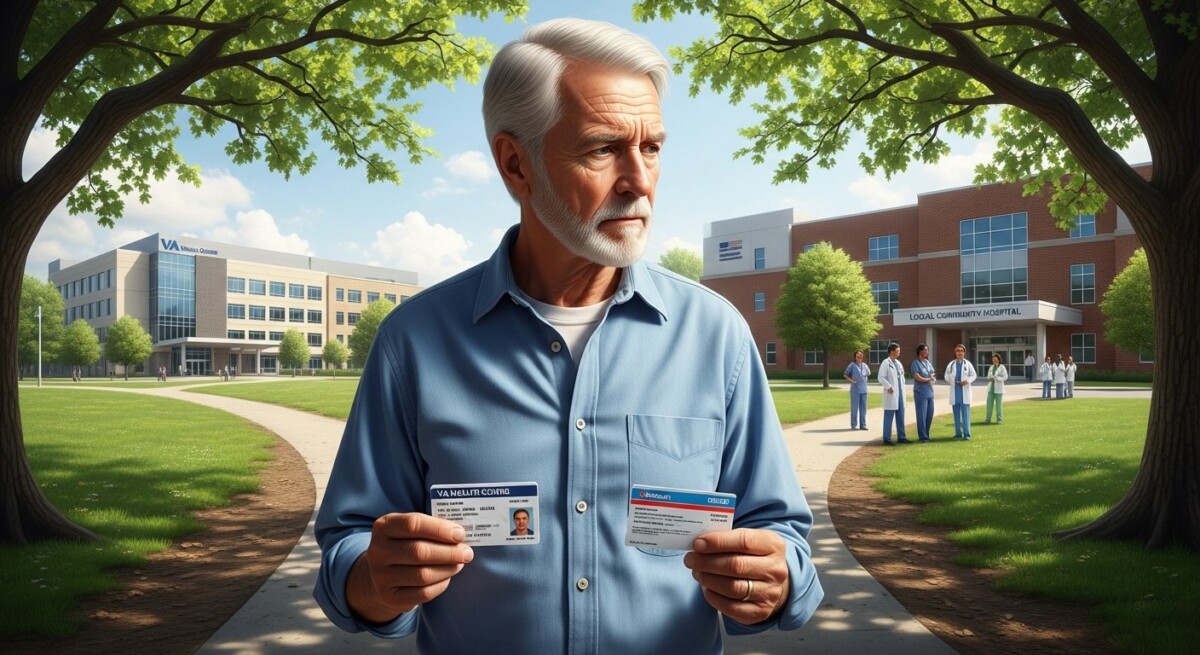

For veterans who have earned comprehensive healthcare through the Department of Veterans Affairs (VA), navigating the world of Medicare can feel confusing and even unnecessary. You might be asking yourself a pivotal question: do you need Medicare Part B if you have VA coverage? The answer is not a simple yes or no, but a strategic decision that hinges on your current health needs, future security, and access to care. While VA benefits are a powerful and deserved entitlement, relying on them exclusively can create significant gaps and financial risks, especially as you age. Understanding the interaction between these two systems is essential for building a robust, flexible healthcare safety net that protects you no matter where you seek treatment.

Understanding the Core Difference: VA Benefits vs. Medicare

VA healthcare and Medicare Part B are fundamentally different programs with distinct rules, networks, and purposes. VA healthcare is a benefit earned through military service. It is not insurance, but a comprehensive healthcare system provided by the federal government specifically for eligible veterans. Care is typically delivered at VA medical centers and clinics by VA-employed providers. Your eligibility and cost-sharing (like copays) are based on factors like your service-connected disability rating, income level, and other criteria. The VA system is excellent for those who live near its facilities and whose health needs align with its services, but it operates as a closed network.

Medicare Part B, on the other hand, is a federal health insurance program for people aged 65 and older, and some younger individuals with disabilities. It is not tied to military service. When you enroll in Part B and pay the monthly premium, you are purchasing insurance that follows you anywhere in the United States. It allows you to see any doctor or specialist who accepts Medicare, receive outpatient services, and access durable medical equipment. This portability and choice are its greatest strengths. The critical distinction is this: VA coverage is a system you go to, while Medicare Part B is portable coverage that goes with you. This difference forms the bedrock of your decision.

The Strategic Case for Enrolling in Medicare Part B

Choosing to enroll in Medicare Part B while using VA benefits is often a decision for enhanced security and flexibility. It is about mitigating risk. The VA itself recommends that eligible veterans consider enrolling in Medicare when they turn 65 to broaden their access to care. There are several compelling reasons to add Part B to your VA coverage, creating a powerful dual-eligibility status that offers unparalleled protection.

First, and most importantly, Medicare Part B gives you access to the vast majority of healthcare providers nationwide. If you need to see a specialist quickly, want a second opinion from a non-VA doctor, or require emergency or urgent care while traveling far from a VA facility, Medicare Part B will cover these services (subject to its deductibles and coinsurance). Without it, you risk facing 100% of the costs for non-VA emergency care unless the VA specifically authorizes it in advance, which is not always possible. Second, enrolling when you are first eligible helps you avoid the lifelong Medicare Part B Late Enrollment Penalty. This penalty adds 10% to your monthly premium for each full 12-month period you could have had Part B but didn’t, and it lasts for as long as you have Part B.

Third, having both coverages can provide valuable backup. For instance, if the VA cannot provide a specific service in a timely manner (a common issue with certain specialties or in rural areas), you can use your Medicare benefits to seek care in the private sector without waiting for a VA community care referral. This dual coverage also future-proofs your care. Your health needs or proximity to VA facilities may change, and having Medicare ensures you have continuous coverage options. For a deeper look at how Part B interacts with other types of insurance, our article on Medicare Part B with other insurance provides essential insights.

Consider these key scenarios where having Medicare Part B alongside VA coverage is critically advantageous:

- Living or Traveling Outside VA Network Areas: If you reside in a rural area far from a VA clinic or enjoy traveling, Medicare ensures you are covered for non-emergency outpatient care anywhere.

- Seeking Specialized or Expedited Care: Access to a wider network can mean shorter wait times for appointments, procedures, or specialist consultations.

- Planning for Long-Term Care Needs: While neither program covers custodial long-term care extensively, Medicare Part B covers certain home health services and medically necessary outpatient therapy that the VA may not.

- Protecting Against Future VA Budget or Eligibility Changes: Healthcare policies and funding can shift. Medicare provides a stable, statutory backup plan.

Potential Drawbacks and Costs of Dual Coverage

While the benefits are significant, enrolling in Medicare Part B is not without its costs and considerations. The primary drawback is the monthly premium. For 2024, the standard Part B premium is $174.70 per month, though higher-income earners pay more through Income-Related Monthly Adjustment Amounts (IRMAA). This is an out-of-pocket expense that you must budget for, regardless of how much you use the VA system. Additionally, Medicare Part B has its own cost-sharing requirements, including an annual deductible ($240 in 2024) and typically 20% coinsurance for most services. You would be responsible for these costs when you use Part B services.

It is also important to understand that VA benefits and Medicare do not coordinate benefits like two private insurance plans might. They operate side-by-side. When you receive care at a VA facility, the VA pays for those services. When you receive care from a non-VA provider who accepts Medicare, Medicare Part B is your primary payer (after you meet its deductible), and you are responsible for the coinsurance. The VA will not pay your Medicare cost-sharing. This means you must be mindful of which system you are using for each healthcare encounter and understand the respective financial responsibilities. For veterans who are also eligible for Medicaid, the coordination rules differ, which we explore in our guide on Medicare Part B with Medicaid.

Making Your Decision: A Step-by-Step Framework

Deciding whether you need Medicare Part B requires a personalized assessment. Follow this framework to evaluate your situation.

First, assess your current and anticipated healthcare usage. How often do you use the VA system? Are you satisfied with the wait times and specialty care access? Do you have chronic conditions that require frequent specialist visits or therapies that might be easier to access in the private sector? Project your needs five or ten years down the line. Second, evaluate your geographic situation. Is a VA medical center or clinic conveniently located for your primary and specialty care needs? Do you plan to move or spend significant time in areas without easy VA access? If you answered yes to the latter, Part B becomes more valuable.

Third, analyze your financial capacity. Can you comfortably afford the monthly Part B premium without financial strain? Would the potential out-of-pocket costs for Medicare services (deductible, 20% coinsurance) be manageable, or would you need a Medicare Supplement Plan to help cover them? Weigh this against the potential risk of enormous bills from non-VA emergency care or the convenience cost of traveling long distances for VA care. Finally, consider your risk tolerance. Are you comfortable with the possibility of facing gaps in coverage or high costs if your health or circumstances change suddenly? Enrolling in Part B is ultimately an investment in healthcare flexibility and insurance against the unknown.

Enrollment Timelines and Penalties to Avoid

If you decide that Medicare Part B is right for you, timing your enrollment is crucial to avoid lifelong penalties. Your Initial Enrollment Period (IEP) is a seven-month window that begins three months before the month you turn 65, includes your birthday month, and ends three months after. This is the best time to enroll, as you will face no penalties and coverage can start promptly. If you are already receiving Social Security or Railroad Retirement Board benefits, you will typically be enrolled in Part A and Part B automatically when you turn 65. If you wish to decline Part B (because you have VA coverage, for example), you must follow the instructions to opt out.

If you miss your IEP and do not have other creditable coverage (VA coverage is generally considered creditable), you will face the Late Enrollment Penalty for Part B. You can only enroll later during the General Enrollment Period (January 1 to March 31 each year), with coverage starting July 1. There is also a Special Enrollment Period (SEP) if your VA coverage ends or you move out of a VA service area. However, relying on an SEP requires careful documentation and understanding of the rules. Procrastination can be very costly. For those considering Medicare Advantage as an alternative to Original Medicare, it’s important to understand why you might need Medicare Part C and how it differs from VA benefits.

Frequently Asked Questions

Q: If I have a high VA priority group or 100% service-connected disability, do I still need Part B?

A> Even with the most comprehensive VA coverage (Priority Group 1), you are still limited to the VA network for routine care. Part B remains valuable for access to non-VA providers, emergency care while traveling, and avoiding future penalties. Your VA coverage does not exempt you from Medicare rules.

Q: Will the VA pay my Medicare Part B premium?

A> No. The VA does not pay Medicare premiums. You are responsible for the monthly Part B premium paid to Medicare.

Q: Can I use VA benefits and Medicare Part B together for the same service?

A> No. You cannot bill both for the exact same service. You choose which benefit to use for each episode of care. They are separate payers for separate services.

Q: I am under 65 and receive VA health care due to a disability. Should I enroll in Medicare?

A> If you are under 65 and receive Social Security Disability Insurance (SSDI) for 24 months, you will be automatically enrolled in Medicare Parts A and B. You can choose to keep both. Having Medicare Part B in addition to VA coverage is often advisable for the same reasons of flexibility and access.

Q: How do I enroll in Medicare Part B if I have VA coverage?

A> You can enroll online through the Social Security Administration website, by calling Social Security, or by visiting a local Social Security office. Have your military service information and VA details handy.

The decision to enroll in Medicare Part B when you have VA coverage is one of the most important healthcare choices a veteran can make at age 65. It requires moving beyond the assumption that VA care is sufficient and toward a proactive strategy for lifelong health security. By carefully weighing the costs of premiums against the risks of limited access and potential penalties, you can make an informed choice that honors your service by ensuring you have the broadest possible access to quality care in your later years. The peace of mind that comes from having portable, reliable coverage wherever life takes you is, for many, the ultimate benefit.