Seniors at Risk? The Truth About Project 2025 Medicare Changes

Project 2025 is coming — and if you’re 65 or older, your Medicare could be on the chopping block. Here’s what every senior needs to know before 2025 hits.

As lawmakers prepare to make sweeping changes to federal programs, seniors across the U.S. are bracing for what may be the most serious threat to Medicare in decades. Project 2025, a major political initiative, is raising alarm bells — and for good reason.

Let’s break it all down and show you what you can do right now to protect your healthcare and secure a better plan.

What Is Project 2025 and Why Are Seniors Worried?

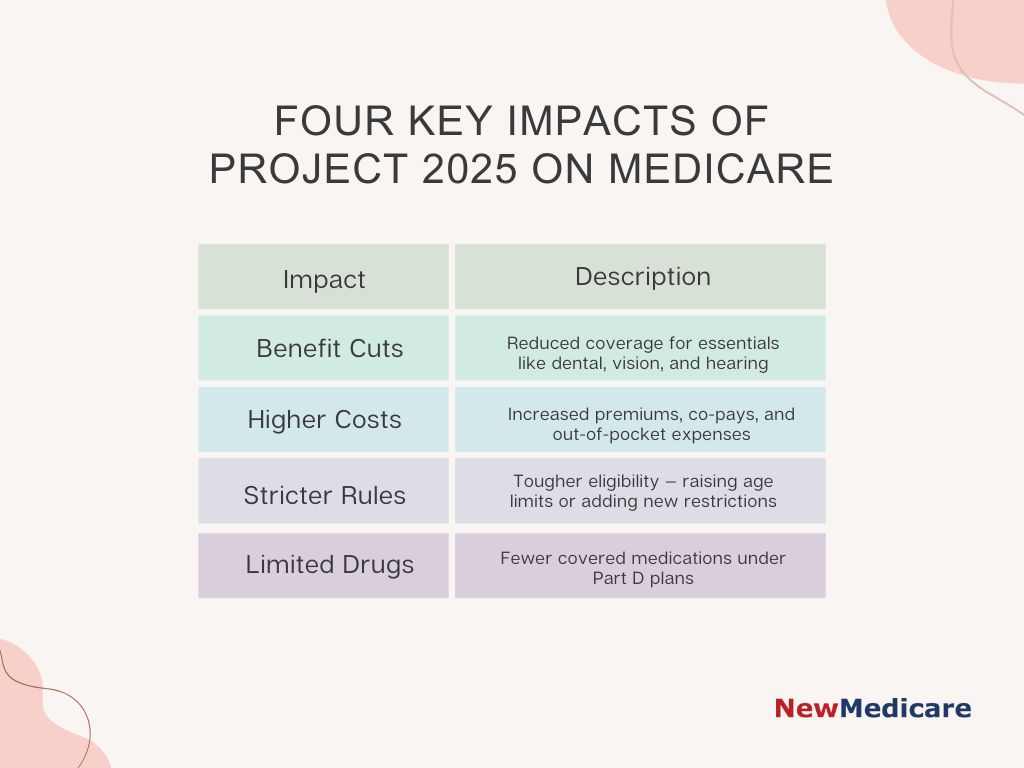

Project 2025 is a federal policy initiative aiming to reduce government spending drastically, with Medicare targeted for significant budget cuts. While the full details are still unfolding, many experts warn that these changes could:

-

Reduce Medicare benefits seniors depend on

-

Increase premiums and out-of-pocket costs

-

Change eligibility rules making it harder to qualify

-

Limit coverage for prescription drugs and essential services

Important Note: These cuts are not just theory. Some proposals under Project 2025 have already sparked debate in Congress, and if passed, they could take effect as soon as 2025.

Why You Can’t Afford to Ignore This

If you rely on Medicare for your healthcare needs, these cuts could seriously affect your quality of life.

Potential Impacts Include:

-

Loss of access to certain doctors and specialists

-

Higher co-pays for doctor visits and prescriptions

-

Reduced coverage for essential services like vision, dental, and hearing

-

Increased financial burden on fixed incomes

Tip: Review your current Medicare coverage today. Understanding what you have will help you spot any gaps or vulnerabilities that new policies might expose.

How Seniors Can Prepare for Project 2025 Medicare Cuts

While you can’t control policy changes, you can control your Medicare plan choice. Here are actionable steps to protect yourself:

1. Review Your Current Plan Carefully

Check your coverage details, premiums, deductibles, and out-of-pocket maximums. Are you prepared if your costs suddenly rise?

2. Shop Around During Open Enrollment

Every year, Medicare’s Open Enrollment period (Oct 15–Dec 7) lets you change plans. Use this time to compare options, especially Medicare Advantage plans that might offer better benefits.

Important Note: Even if you’re happy with your plan now, changes in 2025 could mean it no longer meets your needs.

3. Consider Medicare Advantage Plans

Many Medicare Advantage plans now cover extras that Original Medicare does not, including dental, vision, hearing, and wellness programs. These benefits can help reduce your overall healthcare costs.

4. Look Into Medicare Supplement Plans (Medigap)

If you prefer Original Medicare, a Medigap plan can help cover gaps in coverage, like copays and deductibles. This can be a valuable buffer if Project 2025 cuts increase your out-of-pocket costs.

For official information or questions about your Medicare benefits, call the official Medicare.gov number at 1-800-MEDICARE (1-800-633-4227).

How to Find a Better Medicare Plan Now

You don’t have to wait for the changes to take effect to get better coverage.

Steps to Take Today:

-

Call a licensed Medicare agent: They can review your current plan, explain your options, and help you find a plan that fits your needs and budget.

-

Compare plans online: Use trusted websites like NewMedicare.com to see all the options available in your area.

-

Check for additional benefits: Look for plans with perks like prescription drug coverage, transportation assistance, and wellness programs.

Why Acting Early Is Critical

Project 2025 Medicare cuts could be announced or implemented suddenly. Waiting until the last minute could leave you scrambling with fewer options. Starting your research and plan comparison now means:

-

More time to understand your choices

-

Better chances to secure plans with extra benefits

-

Peace of mind knowing you’re prepared

Real Stories: How Seniors Are Adjusting

Many seniors have already started switching to plans that protect them better. For example:

-

Maria, 70, switched to a Medicare Advantage plan that includes dental and vision coverage, saving her hundreds in additional expenses.

-

James, 67, added a Medigap supplement to reduce his prescription drug costs and avoid surprise hospital bills.

Their advice? Don’t wait until changes hit — take control of your coverage now.

FAQs

What will happen to Medicare in 2025?

Medicare may face budget cuts, eligibility changes, and a push toward privatization under Project 2025.

How much will Medicare Part B cost in 2025 for seniors?

It’s projected to rise to between $185–$190 per month, up from $174.70 in 2024.

Why are people dropping Medicare Advantage plans?

Due to high costs, narrow provider networks, and increased denial of care.

What is catastrophic coverage for Medicare in 2025?

A limit on annual out-of-pocket drug costs is expected to be lowered in 2025 unless repealed by reforms.

Will the eligibility age change in 2025?

Possibly. Project 2025 proposes raising the Medicare eligibility age from 65 to 67 or higher.

Can I keep my doctor under the Project 2025 reforms?

Possibly not—reduced provider reimbursement and plan restrictions may limit access.

Final Thoughts

Project 2025 Medicare cuts represent a significant threat to the healthcare security of millions of seniors across the country. These proposed changes could mean reduced coverage, higher out-of-pocket expenses, and stricter eligibility requirements—challenges no senior should have to face unprepared.

But here’s the good news: You have the power to take control of your healthcare today. By staying informed, reviewing your current Medicare coverage, and exploring alternative plans—especially Medicare Advantage and Medigap supplement options—you can safeguard yourself against unexpected costs and benefit losses.

Don’t wait until the cuts take effect and your options become limited. Early preparation gives you a strategic advantage to secure a plan that fits your health needs and budget, ensuring peace of mind for years to come.

Healthcare is one of the most important investments you’ll ever make. Make sure you have the right plan to protect yourself and your loved ones from the uncertainty of Project 2025. Your future health and financial security depend on the choices you make today.