2025 Medicare Cuts Are Coming—Act Now to Keep Your Coverage and Costs Low

If you’re on Medicare—or about to enroll—you need to know what’s coming. Major cuts to the program are expected in 2025, and they could mean:

-

Higher premiums and out-of-pocket costs

-

Fewer doctors accepting Medicare

-

Reduced access to medications and preventive services

These changes could significantly affect your healthcare and finances. If you don’t act early, you could lose critical coverage or face unexpected medical bills.

Don’t wait. Call 1-800-MEDICARE (the official Medicare.gov line) or visit Medicare.gov to ask questions and verify your plan details.

Why Are Medicare Cuts Happening in 2025?

Medicare spending has been rising rapidly due to inflation, longer life expectancies, and increased demand for chronic care. In 2025, the federal government will implement cost-saving measures targeting:

-

Provider reimbursement rates

-

Medicare Advantage funding

-

Covered benefits and plan extras

While these medicare cuts aim to preserve Medicare’s long-term stability, they’ll have immediate effects on beneficiaries and healthcare providers.

What Will These Cuts Mean for You?

1. You May Have Trouble Finding a Doctor

Lower payments to providers could lead many to:

-

Stop accepting Medicare patients

-

Reduce appointment availability

-

Shrink their service areas, especially in rural communities

Quick Tip: If you already have a preferred doctor or specialist, confirm early that they’ll continue accepting Medicare patients in 2025.

2. Expect Changes in Covered Benefits and Plan Extras

Both Original Medicare and Medicare Advantage plans may offer less in 2025:

-

Higher deductibles and coinsurance

-

Reduced rehab and skilled nursing coverage

-

Stricter rules for hospital admissions and procedures

-

Fewer extras like dental, vision, or fitness benefits under Advantage plans

3. Prescription Drug Costs May Rise

Part D plan changes could include:

-

Higher copays for brand-name and specialty medications

-

Stricter formularies (lists of covered drugs)

-

Reduced access to newer or expensive drugs

-

More drugs being moved into higher-priced tiers

Note: Drug tier changes can significantly raise what you pay, even if the medication itself hasn’t changed.

Tip: Always check your plan’s formulary during open enrollment. Ask your doctor about switching to generic or therapeutic alternatives if needed.

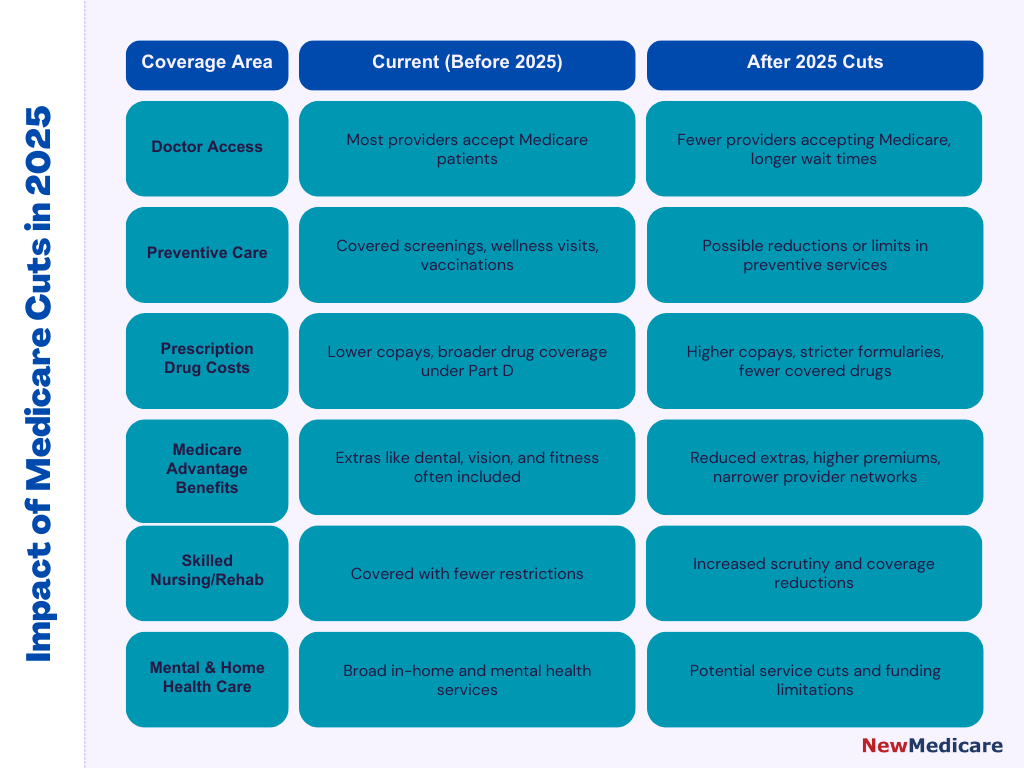

Here’s a quick visual summary of how Medicare benefits and costs could change in 2025:

How to Protect Your Coverage and Your Wallet

The good news? You can take action today.

Step 1: Review Your Medicare Plan

Visit Medicare.gov or use the Plan Finder tool to compare benefits, costs, and providers.

Or call the official Medicare helpline at 1-800-MEDICARE to get help understanding your options.

Step 2: Consider a Medigap (Supplemental) Policy

If you’re on Original Medicare, a Medigap plan can help cover out-of-pocket costs like deductibles and coinsurance. Plan options vary by state.

Step 3: Explore Medicare Savings Programs (MSPs)

If you qualify based on income and assets, MSPs can help pay for premiums, deductibles, and coinsurance. Apply through your state’s Medicaid office.

Step 4: Stay Informed Through Advocacy Groups

Groups like AARP, the Medicare Rights Center, and local SHIP counselors can keep you updated and connect you with support.

Step 5: Get Free Expert Help

Licensed Medicare agents and SHIP counselors provide free, unbiased advice—especially useful during open enrollment (October 15–December 7).

Take control before the cuts take effect. Call (833) 203-6742 or visit NewMedicare.com to compare Medicare quotes and ensure you’re not overpaying—or under-covered.

Long-Term Effects: What the Future Could Look Like

-

Innovation may slow: Lower reimbursements could discourage investment in new treatments.

-

Rural and low-income patients could suffer most: Access to care may decline where options are already limited.

-

More provider consolidation: Smaller practices may close or merge, reducing competition and access.

Frequently Asked Questions About Medicare Cuts 2025

What is the Medicare pay cut for 2025?

In 2025, Medicare is expected to implement a pay cut averaging around 4-5% for healthcare providers, including doctors and hospitals. This reduction is part of broader federal efforts to control healthcare spending. Lower reimbursements may affect how many Medicare patients providers accept and could influence the availability and timeliness of care.

What are the new changes in Medicare for 2025?

Medicare changes in 2025 include reduced payments to providers, possible adjustments to covered services, and potential increases in premiums and out-of-pocket costs. Some preventive services and prescription drug benefits may also see changes. Beneficiaries should watch for updates on plan options during the annual enrollment period to ensure their coverage still meets their needs.

What happens if Medicare gets cut?

If Medicare funding is cut, it could mean fewer services covered, higher costs for beneficiaries, and longer wait times for appointments. Providers may limit the number of Medicare patients they see, which can reduce access to care. Seniors and other beneficiaries might face financial strain and have to make tough choices about their healthcare.

Will Medicare run out of money in 2026?

According to recent government projections, Medicare’s Hospital Insurance Trust Fund, which pays for inpatient care, is estimated to face funding challenges around 2026 if no changes are made. This does not mean Medicare will disappear, but it could require lawmakers to increase funding, cut benefits, or raise taxes to keep the program solvent.

Final Thoughts: You Don’t Have to Navigate This Alone

Navigating Medicare can feel overwhelming—but it doesn’t have to be. With policy updates and changes rolling out in 2025, now is the time to review your current plan, understand your coverage, and make informed decisions about your healthcare future.

Whether you’re turning 65 soon, already enrolled, or helping a loved one understand their Medicare options, having expert guidance can make all the difference. From Original Medicare and Advantage plans to supplemental coverage and prescription drug benefits, there’s a solution tailored to meet your needs and budget.

The best plan is one that works for your lifestyle, protects your health, and saves you money.

But you won’t know what’s available until you compare—and you don’t have to do it alone.

Get expert help today! Call (833) 203-6742 or visit NewMedicare.com to compare free Medicare quotes and find the plan that fits you best.