Medicare 2025: Cuts or Coverage? Find Out What’s Really Happening

Millions of seniors rely on Medicare to cover their healthcare — but big changes could be coming in 2025 that may put your coverage and savings at risk.

Are Medicare cuts really happening?

Will your premiums skyrocket?

Could you lose important benefits like dental or vision?

The truth is, the 2025 Medicare landscape is uncertain — and it’s critical you understand what’s on the horizon NOW so you can protect yourself and your family.

Why This Matters: Medicare Cuts Could Affect You More Than You Think

Medicare is more than just a government program — it’s a lifeline for over 64 million Americans, including seniors, disabled individuals, and their families. Changes to Medicare funding or coverage could:

-

Increase your monthly premiums — making it harder to afford

-

Raise your out-of-pocket costs for doctor visits, hospital stays, medications, and more

-

Cut back coverage for dental, vision, hearing, and other essential services

-

Restrict your access to doctors and specialists due to tougher eligibility rules or reduced reimbursements

For seniors living on fixed incomes, these changes could mean choosing between medications and groceries — a tough reality no one wants to face.

What’s Happening with Medicare Funding in 2025?

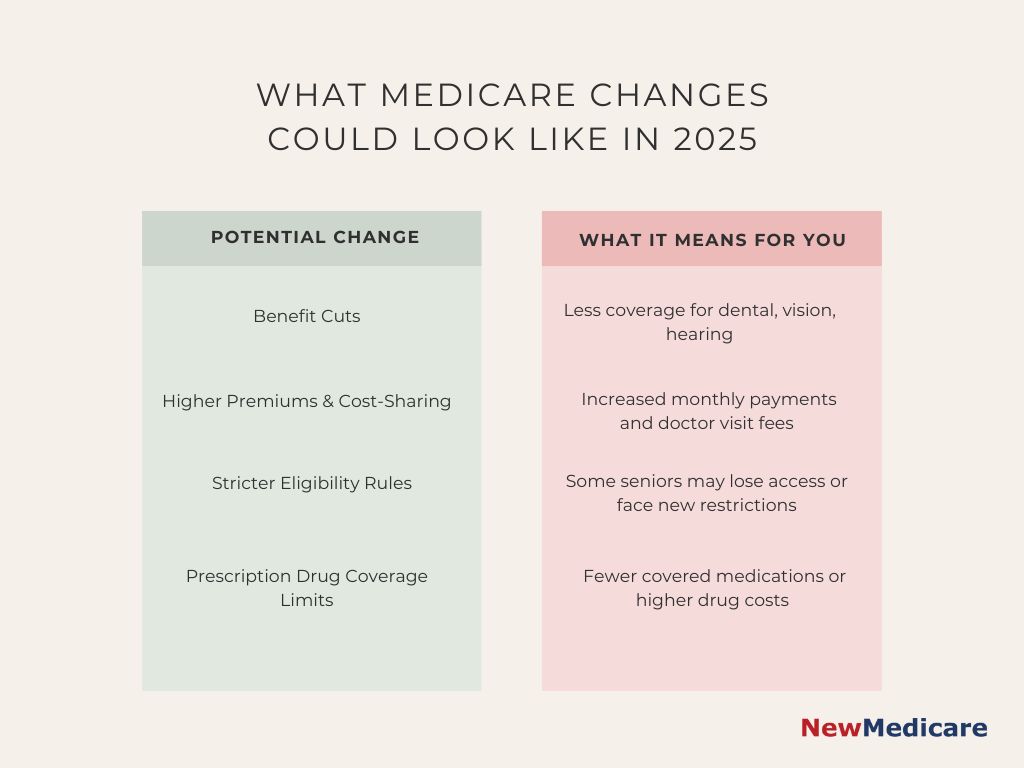

Federal budget discussions and healthcare reform debates have put Medicare funding in the spotlight. While no official cuts are confirmed yet, here’s what’s on the table:

-

Potential reductions in funding for some benefits, especially preventive and outpatient services

-

Higher premiums and cost-sharing for Medicare Part B (doctor services) and Part D (prescription drugs)

-

Stricter eligibility rules — meaning some could lose coverage or face more hoops to jump through

-

Changes to Medicare drug plans, possibly limiting coverage for some medications

These proposals are part of broader attempts to control federal spending, but they could directly impact healthcare costs and coverage.

Important Note: If you have specific questions or need personalized information, call the official Medicare number at 1-800-MEDICARE (1-800-633-4227). Representatives can help clarify your current benefits and any changes expected in 2025.

Key Factors Driving Possible Medicare Changes

Understanding why Medicare might be cut or changed can help you prepare better. Here are the main influences:

1. Economic Conditions

Economic downturns reduce tax revenues, which fund Medicare. For example, during the 2008 recession, Medicare faced tight budgets due to lower government income.

2. Legislative Changes

Congress and policymakers regularly debate Medicare reform to balance cost control and beneficiary protection. Recent laws like the Affordable Care Act have already reshaped parts of Medicare funding.

3. Demographic Shifts

With baby boomers aging, the number of Medicare beneficiaries is growing rapidly — expected to surpass 80 million by 2030. More beneficiaries mean higher program costs and pressure on the federal budget.

How These Changes Impact Seniors and Healthcare Providers

For Seniors

-

Financial Strain: Increased costs mean many seniors might skip medications or delay care.

-

Access Issues: Reduced provider reimbursements could lead to fewer doctors accepting Medicare patients, causing longer wait times.

For Healthcare Providers

-

Lower payments may force clinics to cut services or limit Medicare patient numbers.

-

Community health programs might face funding shortfalls, impacting care availability.

What You Can Do NOW to Protect Yourself

Don’t wait for changes to surprise you. Here’s how to stay ahead:

-

Review Your Medicare Plan Annually: Medicare’s open enrollment runs from October 15 to December 7 every year. Check if your current plan still meets your needs or if there’s a better option.

-

Consider Supplemental Coverage: Plans like Medigap or Medicare Advantage can help cover gaps in traditional Medicare.

-

Stay Informed: Monitor trusted sources and government announcements about Medicare changes.

-

Seek Expert Advice: Speak to licensed Medicare counselors or advisors who can guide you based on your unique situation.

Quick Tip: Mark your calendar for the Medicare open enrollment period (Oct 15 – Dec 7). Missing this window can lock you into an expensive or insufficient plan for another year!

Public Opinion and Future Outlook

Medicare cuts remain a hot topic among politicians, seniors, and healthcare providers. While many fear cuts, there’s also strong bipartisan support for reforming Medicare to make it sustainable without sacrificing essential benefits.

Advocates push for modernization — like better telehealth options and improved prescription drug pricing — which could benefit seniors in the long run. But until legislation is finalized, uncertainty remains.

FAQ: Medicare Updates and Costs

What is the new rule for Medicare 2025?

The new Medicare rule in 2025 focuses on expanding coverage options, improving access to preventive services, and addressing prescription drug costs for seniors.

What happens if Medicare is cut?

If Medicare funding is reduced, it could result in fewer benefits or higher out-of-pocket costs for beneficiaries. It may also limit access to certain healthcare services.

What will happen to Medicare in 2026?

In 2026, Medicare may see further reforms focused on reducing prescription drug prices and expanding coverage for chronic conditions, depending on legislative changes.

How much will Medicare Part B cost in 2025 for seniors?

The cost of Medicare Part B in 2025 is projected to increase slightly, but exact rates will be determined by the Social Security Administration closer to the year.

Take Control of Your Medicare Future Today

The Medicare changes on the horizon for 2025 may seem overwhelming, but being informed and proactive puts you in the driver’s seat. Review your coverage options, stay updated on policy shifts, and seek advice tailored to your unique needs.

By taking these steps now, you can protect your benefits, avoid unexpected costs, and ensure the healthcare you and your family rely on remains secure.

Your health and peace of mind are worth the effort — start preparing today for a safer, more confident tomorrow.

Finding the right Medicare plan shouldn’t be hard—get started now at NewMedicare.com or call (833) 203-6742!