Humana Plans Health Coverage Gold Sign Ups: Enrollment, Benefits, and Competitive Analysis

Medicare Advantage (Part C) has become the cornerstone of healthcare for millions of seniors, offering an alternative to Original Medicare through private insurers. As of 2023, over 29 million Americans—nearly half of all Medicare beneficiaries—are enrolled in Medicare Advantage plans, a 10% increase from 2022. This surge is driven by:

- Cost predictability: Fixed copays and out-of-pocket maximums.

- Added benefits: Dental, vision, and wellness programs not covered by Original Medicare.

- Simplified care: Bundling Parts A (hospital), B (medical), and often Part D (prescriptions) into one plan.

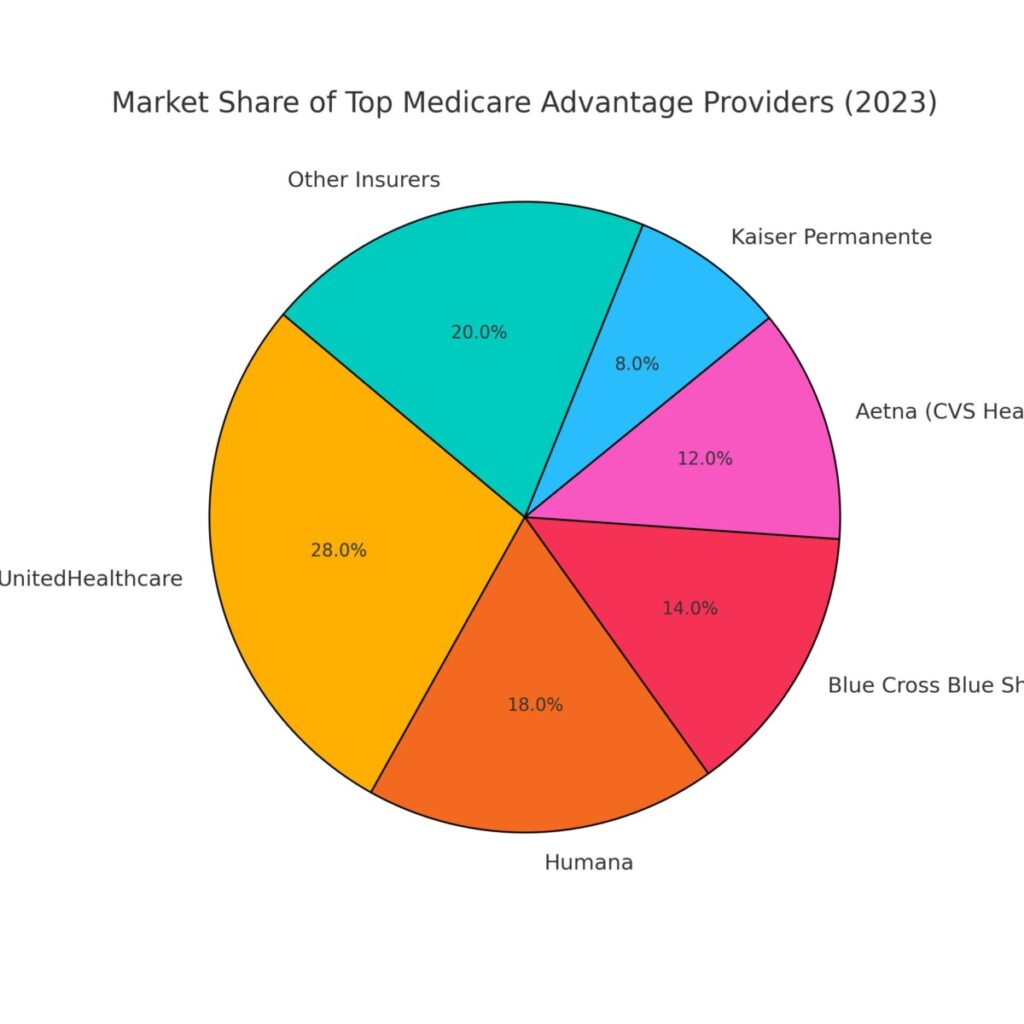

Humana, a leader in the Medicare Advantage market, holds 18% of the national market share, serving over 5 million beneficiaries. Its Gold-tier plans are particularly popular, combining affordability with robust coverage.

Why Humana Gold Plans?

Humana Gold plans stand out for their $0 premiums in 90% of service areas and comprehensive extras like dental cleanings, gym memberships, and chronic condition management. These plans cater to seniors who prioritize:

- Preventive care: Free annual wellness visits and vaccinations.

- Budget-friendly coverage: Capped annual out-of-pocket costs ($6,700 in 2023).

- Holistic health: Access to fitness programs (SilverSneakers) and mental health services.

What Are Humana Gold Plans?

Definition: Medicare Advantage Plan (Part C) Combining Parts A, B, and D

Humana Gold plans are Medicare Advantage policies that replace Original Medicare with enhanced coverage. They include:

- Part A: Hospital stays, skilled nursing, hospice.

- Part B: Doctor visits, lab tests, preventive care.

- Part D: Prescription drug coverage (in most plans).

These plans are regulated by Medicare but administered by Humana, allowing flexibility to add benefits like dental and vision.

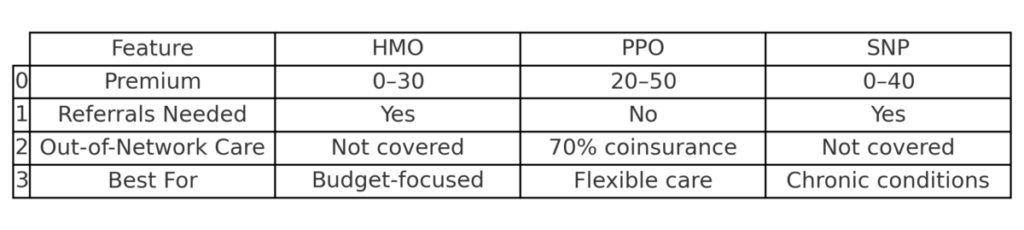

Types of Gold Plans

-

HMO (Health Maintenance Organization):

- Pros: Low premiums (0inmanyareas),0 primary care visits.

- Cons: Requires referrals for specialists; care limited to in-network providers.

- Ideal For: Seniors who prefer coordinated, cost-effective care.

-

PPO (Preferred Provider Organization):

- Pros: No referrals needed; partial coverage for out-of-network care.

- Cons: Higher premiums (20–50/month) and deductibles.

- Ideal For: Frequent travelers or those needing specialized care.

-

SNPs (Special Needs Plans):

- Target Audience: Seniors with chronic conditions (e.g., diabetes, heart failure) or institutionalized individuals.

- Features: Tailored care teams, $0 copays for condition-specific medications.

Key Features

Medical Coverage:

- Hospital stays: $300 copay per day after deductible.

- Emergency care: $90 copay for ER visits.

Prescription Drugs:

- Formulary tiers: Generics (1–10), preferred brands (40–100).

- Mail-order savings: 90-day supplies at 50% off retail pharmacy prices.

Extra Benefits:

- Dental: Two cleanings/year, $1,000 annual coverage for major procedures.

- Vision: Annual eye exams, $200 allowance for frames.

- Hearing: $1,000 toward hearing aids every two years.

- Wellness: Free gym access (SilverSneakers), $100 rewards for health assessments.

Historical Context: Humana’s Role in Medicare Advantage Since 1984

Humana pioneered Medicare Advantage partnerships with the federal government, launching its first HMO in 1984. The Gold-tier plans debuted in 2010, aligning with Medicare’s push toward value-based care. Key milestones:

- 2015: Introduced HumanaVitality wellness rewards.

- 2020: Expanded telehealth coverage during COVID-19.

- 2023: Added $0 premium PPO plans in 40+ states.

Visual: Comparison of Humana Gold Plan Types

Benefits of Humana Gold Plans

Core Medical Coverage

Humana Gold plans provide extensive coverage for essential healthcare needs, ensuring seniors can manage both routine and unexpected medical expenses.

-

Hospital Stays:

-

Inpatient Care: Covers semi-private rooms, surgeries, and nursing care.

- Example: A 3-day hospital stay for pneumonia costs a 300copay(vs.1,600 under Original Medicare).

- Skilled Nursing Facilities: Up to 100 days of post-hospitalization care with a $0 copay.

-

-

Emergency Care:

- ER Visits: $90 copay (waived if admitted).

- Ambulance Services: Covered at 100% for emergencies.

-

Preventive Care:

- Annual Wellness Visits: $0 copay, including personalized health plans.

- Vaccinations: Flu, shingles, and COVID-19 boosters fully covered.

-

Chronic Condition Management:

- Diabetes: Free glucose monitors, test strips, and nutrition counseling.

- Heart Disease: $0 copay for cardiologist visits and cardiac rehab.

- COPD: Access to pulmonary rehab programs and inhalers.

Prescription Drug Coverage (Part D)

Humana Gold integrates Part D, offering predictable pricing and broad access to medications.

-

Formulary Tiers:

- Tier 1 (Generics): 1–10 (e.g., metformin, lisinopril).

- Tier 2 (Preferred Brands): 40–100 (e.g., Januvia, Eliquis).

- Tier 3 (Non-Preferred): 100–150 (e.g., Advair Diskus).

- Specialty Tier: 25–33% coinsurance (e.g., Humira, Orencia).

-

Mail-Order Pharmacy Discounts:

- Save 50% on 90-day supplies through Humana Pharmacy Home Delivery.

Example: A 90-day supply of generic Lipitor costs 10viamailordervs.30 at retail.

Extra Benefits

Humana Gold goes beyond medical care to address holistic health needs:

-

Dental Coverage:

- Basic: Two cleanings/year, X-rays, fillings ($0 copay).

- Major: 50% coinsurance for crowns, root canals (up to $1,000/year).

-

Vision Benefits:

- Annual eye exams (0copay),200 allowance for frames or contacts.

-

Hearing Aids:

- $1,000 allowance every two years for devices and exams.

-

Fitness Memberships:

- Free access to 15,000+ gyms via SilverSneakers or Renew Active.

-

OTC Allowances:

- 50–100 quarterly for vitamins, pain relievers, and first-aid supplies.

-

Transportation:

- 24 one-way rides/year to medical appointments (non-emergency).

Cost-Saving Incentives

Humana Gold prioritizes affordability through:

- $0-Premium Plans: Available in 90% of counties.

- Low Deductibles: 0forprimarycare,100–$500 for hospital stays.

- Out-of-Pocket Maximum: $6,700 (2023 cap), shielding seniors from catastrophic costs.

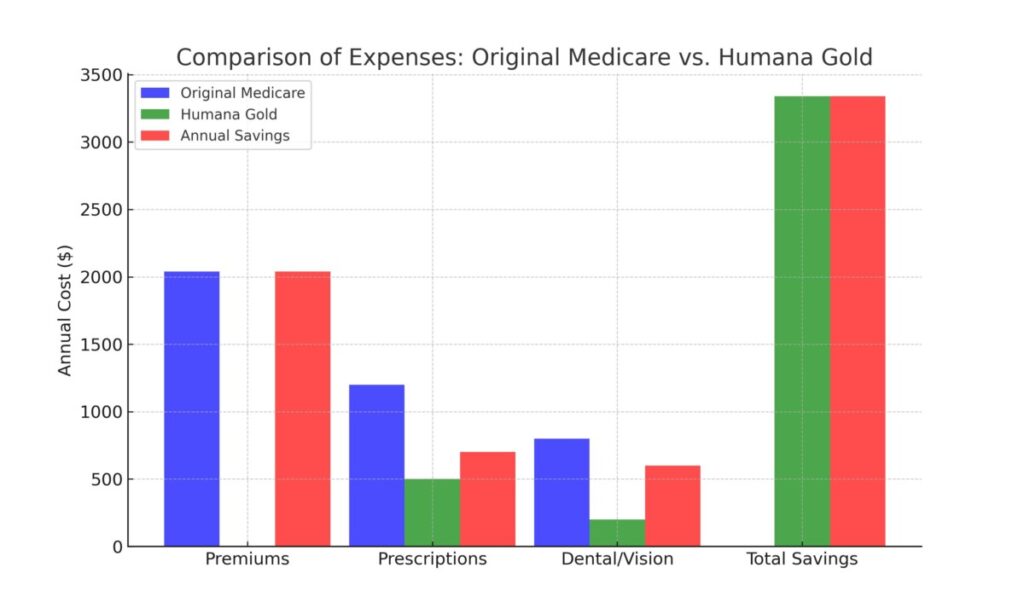

Average Annual Savings with Humana Gold vs. Original Medicare (2023)

Eligibility and Enrollment Process

Eligibility Requirements

- Age: 65+ or under 65 with a qualifying disability (e.g., ESRD, ALS).

- Residency: Live in Humana’s service area (available in 49 states; excludes Alaska).

Note: Dual-eligible seniors (Medicare + Medicaid) can enroll in Special Needs Plans (SNPs).

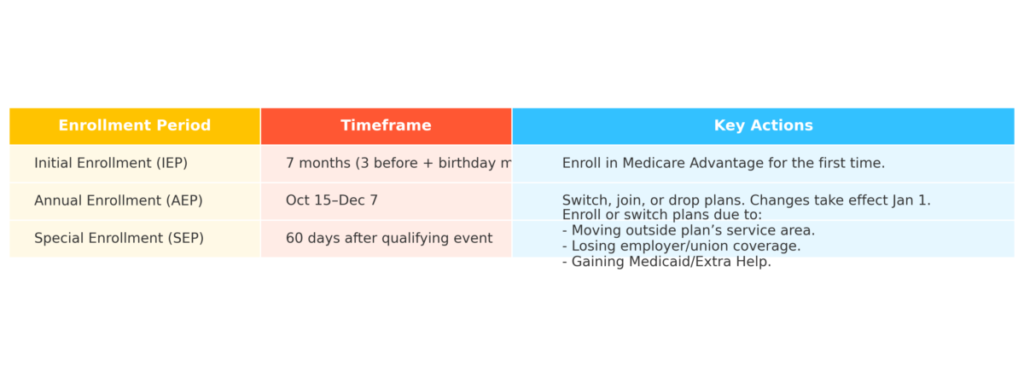

Enrollment Periods

-

Initial Enrollment Period (IEP):

- Begins 3 months before your 65th birthday month and ends 3 months after.

- Late Penalty: 1% permanent premium increase for each month delayed.

-

Annual Enrollment Period (AEP):

- October 15–December 7: Switch, join, or drop plans.

- 2023 Data: 60% of beneficiaries reviewed their coverage during AEP.

-

Special Enrollment Periods (SEPs):

- Qualifying Events: Moving, losing employer coverage, qualifying for Medicaid.

- Duration: 60 days post-event.

Enrollment Timeline Visual

Step-by-Step Signup Guide

-

Compare Plans:

-

- ZIP code.

- Prescription needs (search by drug name).

- Preferred doctors/hospitals.

-

-

Verify Network Providers:

- Check if your current providers are in-network using Humana’s Provider Directory.

-

Submit Application:

- Online: Complete in 20 minutes at Humana.com.

- Phone: Call 1-800-MEDICARE or Humana at 1-800-833-6917.

- Agent: Free assistance via licensed agents (appointments at NewMedicare.com).

-

Review Confirmation:

- Receive a welcome package with ID cards and benefit details within 14 days.

Common Mistakes to Avoid

- Missing Deadlines: Late enrollment can lead to lifelong penalties.

- Ignoring Prior Authorization: Some services (e.g., MRIs, surgeries) require pre-approval.

- Overlooking Formularies: Confirm your medications are covered to avoid surprise costs.

Cost Structure and Financial Considerations

Premiums: 0–50/month (Varies by ZIP Code)

Humana Gold plans are renowned for affordability, with 87% of enrollees paying $0 premiums in 2023. Premiums vary based on:

- Geographic location: Urban areas (e.g., Miami, Los Angeles) often have $0 premiums due to higher Medicare reimbursement rates.

- Plan type: HMO plans typically cost less than PPOs.

- Subsidies: Low-income seniors may qualify for additional premium reductions via Medicaid.

Example:

- Jane in Orlando, FL: $0/month for an HMO plan.

- John in rural Wyoming: $45/month for a PPO plan due to limited network options.

Deductibles: 0–500 for Medical Services

- $0 Deductible: Common for primary care and preventive services.

- Higher Deductibles: Apply to hospital stays or specialized care (e.g., $500 for inpatient surgery).

How It Works:

- If your plan has a 300deductible,youpaythefirst300 for covered services before Humana shares costs.

Copays/Coinsurance

- Primary Care: 0–20 per visit (e.g., annual wellness exams).

- Specialists: 40–75 per visit (e.g., cardiologist, oncologist).

- Urgent Care: 45copayvs.90 ER copay (non-emergency).

Out-of-Pocket Maximum: $6,700 (2023 Cap)

This annual limit includes deductibles, copays, and coinsurance but excludes premiums. Once reached, Humana covers 100% of Medicare-approved services.

Example:

- Mary’s cancer treatment cost 15,000.Shepaid6,700, and Humana covered the remaining $8,300.

Financial Assistance Programs

-

Extra Help:

- Income Limits: 21,870/year(individual);29,580 (couple).

- Benefits: Reduces Part D premiums, deductibles, and copays (e.g., $3.60 for generics).

-

Medicaid Dual Eligibility:

- Covers Medicare premiums, deductibles, and non-medical needs (e.g., transportation).

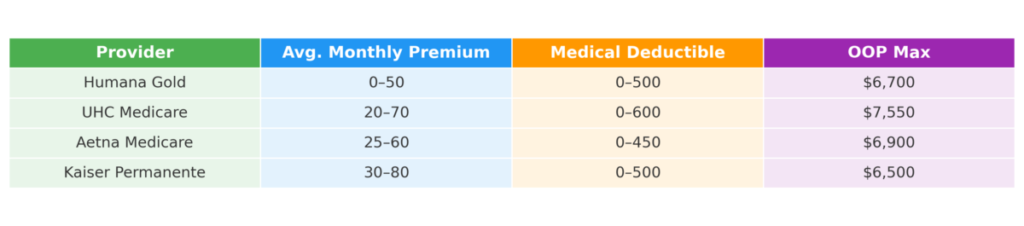

Cost Breakdown of Humana Gold vs. Competitors (2023)

Competitive Analysis

Top Competitors

-

UnitedHealthcare (UHC):

- Strengths: Largest network (1.3M+ providers), $0 telehealth.

- Weaknesses: Higher OOP max ($7,550).

-

Aetna (CVS Health):

- Strengths: 0OTCallowances(50/month), Attain Health app.

- Weaknesses: Lower dental coverage ($750/year).

-

Kaiser Permanente:

- Strengths: Top-rated HMO model (4.5 CMS stars), integrated care.

- Weaknesses: Limited to 8 states.

-

Blue Cross Blue Shield (BCBS):

- Strengths: Strong regional networks, mental health focus.

- Weaknesses: Higher premiums in rural areas.

Humana’s Strengths and Weaknesses

-

Strengths:

- Nationwide Network: 350,000+ providers and 4,700 hospitals.

- Wellness Programs: SilverSneakers engages 2M+ seniors annually.

-

Weaknesses:

- Rural Access: Limited specialists in states like Montana and Alaska.

- Specialist Copays: 75vs.UHC’s50 average.

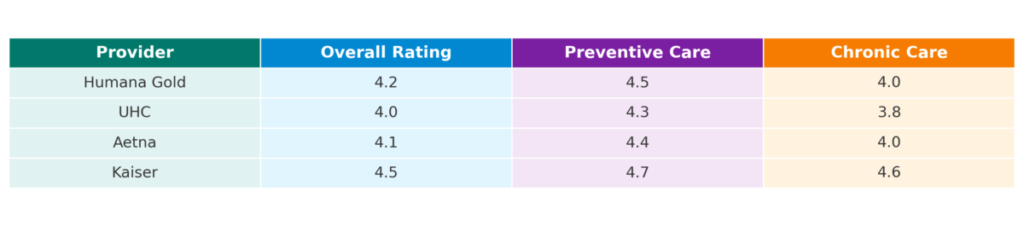

Market Share of Top Medicare Advantage Providers (2023)

Customer Satisfaction and Reviews

CMS Star Ratings: 4.2/5

- Preventive Care: 4.5/5 (e.g., 90% of enrollees receive annual flu shots).

- Chronic Condition Management: 4.0/5 (e.g., diabetes monitoring).

- Customer Service: 3.9/5 (longer wait times reported).

J.D. Power Rankings: #2 in Member Satisfaction

- Strengths: Transparency, claims processing, wellness incentives.

- Weaknesses: Prior authorization delays for non-emergency procedures.

Member Testimonials

- Positive: “My hip replacement was fully covered, and I love my SilverSneakers classes!” – Linda, TX

- Criticism: “It took weeks to approve my MRI.” – Mark, OH

CMS Star Ratings Comparison (2023)

Pros and Cons of Humana Gold Plans

Pros

- $0 Premiums: Ideal for budget-conscious seniors.

- Holistic Coverage: Combines medical, dental, vision, and fitness.

- Wellness Incentives: Rewards for healthy behaviors (e.g., $100 Visa gift cards).

Cons

- Rural Network Gaps: Limited specialists in remote areas.

- Prior Authorization: Required for MRIs, surgeries, and specialty drugs.

How to Maximize Your Humana Gold Plan

Preventive Care Tips

-

Annual Wellness Visits:

- What’s Covered: Personalized prevention plans, cognitive screenings, and health risk assessments.

- Rewards: Earn $100 Visa gift cards through HumanaVitality for completing visits.

- Example: Susan, 68, detected early-stage hypertension during her wellness visit, avoiding costly emergency care.

-

Vaccinations:

- Free Shots: Flu, pneumonia, shingles, and COVID-19 boosters.

- Where to Go: In-network pharmacies (e.g., Walgreens, CVS) or primary care providers.

Using Extra Benefits

-

SilverSneakers:

- Access: 15,000+ gyms nationwide, including LA Fitness and YMCA.

- Classes: Yoga, water aerobics, and strength training tailored for seniors.

-

OTC Allowances:

- Eligible Products: Pain relievers, vitamins, bandages, and dental care items.

- How to Use: Order online via Humana’s OTC portal or purchase at participating retailers (e.g., Walmart).

-

Transportation Services:

- Book Rides: Schedule non-emergency rides to doctors via Humana’s partnership with Lyft.

Appealing Denied Claims

-

Step 1: Request Redetermination

- Deadline: 60 days from denial notice.

- Submit: A written letter or Humana’s online form detailing why the claim should be covered.

-

Step 2: Submit Supporting Documents

- Include: Doctor’s notes, prior authorization requests, and medical records.

-

Step 3: Review Outcome

- Timeline: Humana must respond within 30 days (72 hours for expedited appeals).

Case Study: After Humana denied his MRI, John submitted his neurologist’s referral and won approval in 10 days.

Future Trends in Medicare Advantage

Telehealth Expansion

- 24/7 Virtual Care: Launching in 2024, Humana will offer round-the-clock telehealth for urgent needs (e.g., rashes, infections).

- Specialist Access: Partnerships with Teladoc and Amwell to connect seniors with cardiologists and dermatologists.

AI and Predictive Analytics

- Medication Alerts: AI tools flag harmful drug interactions (e.g., blood thinners + NSAIDs).

- Hospitalization Predictions: Algorithms identify high-risk patients for early interventions, reducing ER visits by 15% (Humana pilot data).

Policy Changes

-

2024 Reforms:

- Prior Authorization Limits: CMS may streamline approvals for common procedures (e.g., joint replacements).

- Cost Caps: Proposed $5,000 out-of-pocket maximum for Part D drugs.

Humana Gold plans offer affordable premiums, holistic coverage, and wellness incentives, making them a top choice for seniors prioritizing value and preventive care.

Action Items

- Compare Plans: Use NewMedicare.com for side-by-side comparisons of premiums, benefits, and provider networks.

- Consult Experts: Schedule a free consultation with licensed agents to address complex needs (e.g., chronic conditions).

- Reassess Annually: Review coverage during AEP (Oct 15–Dec 7) to adapt to changing health needs.

Appendix

Glossary

- Formulary: List of covered prescription drugs.

- Coinsurance: Your share of costs (e.g., 20% of a 100service=20).

- SNPs: Special Needs Plans for chronic conditions or institutionalized individuals.

Resources

- Medicare.gov Plan Finder: https://www.medicare.gov/plan-compare

- Humana Provider Directory: https://www.humana.com/provider-search

FAQs

-

Can I Switch from Medigap to Humana Gold?

- Yes, but you must cancel Medigap during your Medicare Advantage enrollment. Medigap does not work with Medicare Advantage.

-

Are Pre-Existing Conditions Covered?

- Yes. Medicare Advantage plans cannot deny coverage or charge more for pre-existing conditions.