Can’t Afford Hearing Aids? This Insurance for Seniors Changes Everything

Hearing loss doesn’t just affect your ears — it affects your life.

From missing out on conversations with loved ones to struggling to hear the TV, the impact of untreated hearing loss can be profound. For many seniors, it leads to frustration, isolation, and even depression.

But hearing aids are expensive — often thousands of dollars out of pocket.

The good news? Hearing insurance for seniors can help cover the cost, offering savings of up to $4,000 or more. This guide will walk you through your options and show you how to get the support you deserve.

What is Hearing Insurance for Seniors?

Hearing insurance helps older adults cover the high costs of hearing aids and related care. Coverage often includes:

-

Hearing aids (full or partial cost)

-

Audiologist visits and consultations

-

Hearing tests and diagnostics

-

Repairs and maintenance

With the right plan, you can save up to $4,000 or more and avoid major out-of-pocket expenses.

Pro Tip: Always check which types of hearing aids and related services your insurance plan covers before enrolling. Some plans cover only basic models or exclude certain accessories.

Why Hearing Insurance Matters

Here’s why it’s worth considering:

-

Big Savings – Hearing aids alone can cost $1,000–$4,000 each.

-

Better Quality of Life – Improved hearing boosts social and emotional wellbeing.

-

Access to Specialists – Insurance connects you with audiologists for expert care.

-

Early Detection – Covered screenings can catch issues early, before they worsen.

Shocking Statistics About Senior Hearing Loss

-

1 in 3 seniors over 65 experience hearing loss

-

Nearly half of those over 75 have hearing difficulties

-

Untreated hearing loss is linked to cognitive decline, depression, and social isolation

These stats show why insurance coverage isn’t just helpful—it’s essential for maintaining independence and mental health.

Pro Tip: Don’t wait until hearing loss worsens. Schedule a hearing test early to catch issues before they impact your quality of life.

The Link Between Hearing and Quality of Life

Hearing health impacts every part of your life:

-

Social Engagement – Conversations become easier and more enjoyable

-

Mental Health – Reduces isolation, anxiety, and depression

-

Cognitive Health – Studies show hearing loss speeds up cognitive decline

By getting insured, you ensure access to care that can dramatically improve how you live.

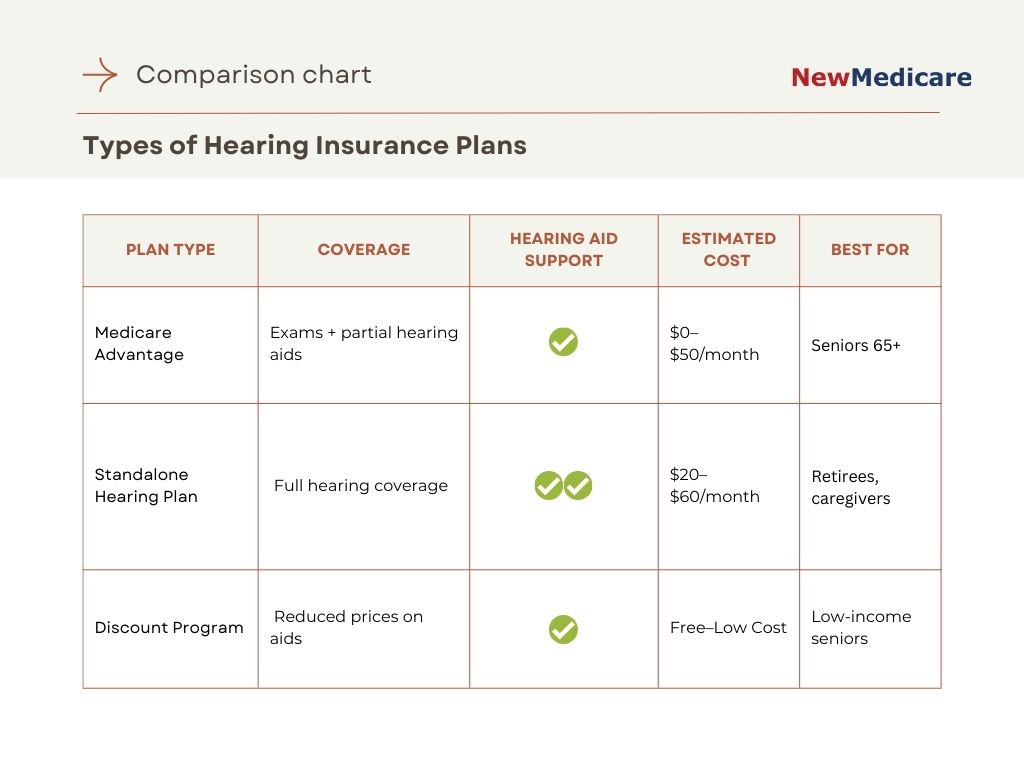

Comparison: Types of Hearing Insurance Plans

Pro Tip: If you’re on Medicare Advantage, verify if hearing aid coverage is included. Coverage varies by provider and plan, so compare options carefully.

Types of Hearing Insurance Plans Explained

1. Medicare Advantage (Part C)

-

May include routine hearing exams and partial aid coverage

-

Plan benefits vary widely by provider

-

About 30% of Medicare Advantage enrollees have hearing coverage

2. Standalone Hearing Insurance

-

Purchased separately (not tied to Medicare)

-

Covers hearing aids, fittings, follow-ups

-

Often offers the most comprehensive benefits

3. Employer-Sponsored or Retiree Plans

-

May continue after retirement

-

Lower cost due to employer subsidies

-

Only about 1 in 5 employers offer hearing benefits

Coverage Options for Hearing Aids

Not all insurance covers hearing aids equally. Here’s what to look for:

Medicare

-

Original Medicare: Doesn’t cover hearing aids

-

Medicare Advantage: May offer limited hearing aid benefits

Medicaid

-

Some states cover hearing aids for eligible seniors

-

Coverage and access vary by state

Private Insurance

-

Varies widely by provider

-

Always read the fine print to know what’s included

Discount Programs

-

Offered by manufacturers or non-profits

-

Can lower hearing aid costs for low-income individuals

Pro Tip: If insurance coverage is limited, look into manufacturer discount programs and nonprofit organizations that offer financial assistance for hearing aids.

How Much Do Hearing Aids Cost?

Hearing aids are one of the biggest out-of-pocket expenses for seniors:

-

Basic model: $1,000–$2,000

-

High-tech model: $4,000–$6,000 per pair

-

Maintenance and follow-up visits: Often not included in base cost

Factors that affect cost:

-

Tech features (Bluetooth, noise canceling)

-

Brand and model

-

Whether fittings and checkups are included

How Hearing Insurance Helps

Here’s what the right hearing insurance can do for you:

-

Offset Hearing Aid Costs – Save thousands on devices and care

-

Cover Exams & Fittings – Prevent issues early and keep hearing aids tuned

-

Provide Ongoing Support – Includes maintenance, replacements, and more

FAQs

What is hearing insurance for seniors?

Hearing insurance for seniors is a specialized type of coverage that helps pay for hearing aids, exams, and more—often saving seniors thousands.

Is hearing going to be covered by Medicare?

Original Medicare doesn’t cover hearing aids, but Medicare Advantage plans may offer coverage for hearing aids and other related services.

To learn more about your Medicare benefits, you can also call the official Medicare.gov number at 1-800-MEDICARE.

How much does hearing aid insurance cost?

Hearing aid insurance can cost between $20 to $50 per month, depending on the plan and coverage level.

Is it worth getting hearing aid insurance?

If you need hearing aids or other hearing-related services, insurance can help offset high costs, making it worthwhile for many people.

Final Thoughts: You Deserve to Hear Life Clearly Again

Hearing loss can feel isolating — but it doesn’t have to be permanent, and it doesn’t have to be unaffordable.

Too many seniors delay getting help because they think hearing aids are out of reach. But with the right insurance, that’s simply not true.

You’ve spent a lifetime listening to your loved ones, sharing laughs, and enjoying the world around you. You deserve to keep doing that — without worrying about the cost of hearing aids or specialist visits.

The first step is easy: find a plan that helps cover your hearing needs. Whether it’s through Medicare Advantage, a standalone policy, or a discount program, there’s a solution out there for you.

You deserve a Medicare plan that fits. Get a free quote now at NewMedicare.com or 📞 (833) 203-6742!