Dental Implant Insurance in 2025: Costs, Coverage & Hidden Exclusions

Don’t Pay $6,000 for Implants – Here’s How Insurance Can Help

Dental implants can transform your smile—but they can also cost a fortune. If you’re wondering whether dental implant insurance is worth it, what it actually covers, and how much you might save, you’re not alone. This guide will break down everything you need to know in 2025 about dental implant insurance, including costs, coverage options, and hidden exclusions.

Quick Tip: Call (833) 203-6742 to compare dental plans that may help cover your implants.

What is Dental Implant Insurance?

Dental implant insurance is a dental coverage plan that either partially or fully pays for dental implant procedures. These procedures often include:

- Initial consultations and imaging (like X-rays or CT scans)

- Tooth extraction (if needed)

- Bone grafting or sinus lifts (if required for jawbone support)

- Implant placement

- Abutment and crown placement

Does Regular Dental Insurance Cover Implants?

In most traditional dental insurance plans, implants are classified as cosmetic procedures, which means they’re not always covered. However, many newer or enhanced plans now offer partial coverage for implants under their major services category.

What Some Dental Plans May Cover:

- Diagnostic exams: Often covered fully

- Extractions: Usually 50–80% coverage

- Implant surgery: Partial (20–50%) or full coverage under select plans

- Abutment and crown: Partial coverage

Pro Tip: Always check the annual maximum benefit—many plans only pay up to $1,500/year, which may not even cover one implant.

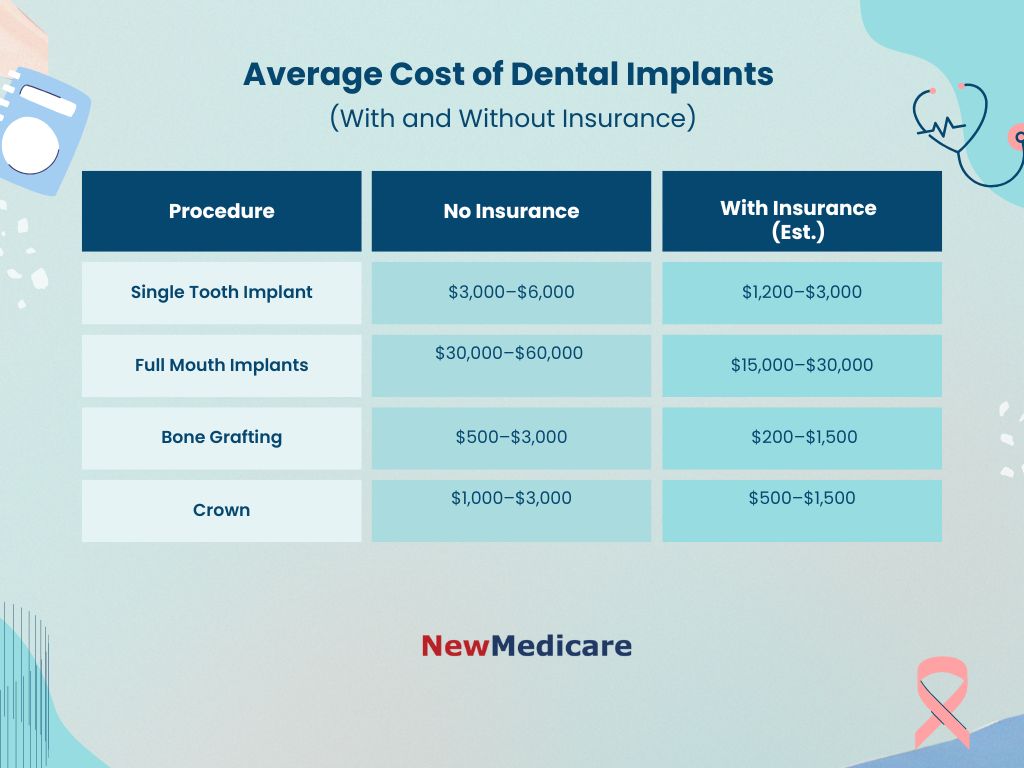

Average Cost of Dental Implants (With and Without Insurance)

Types of Dental Implant Insurance Plans

1. PPO Dental Insurance Plans

- Typically have broader networks

- May offer partial implant coverage

- Higher premiums but more flexibility

2. Discount Dental Plans

- Not true insurance, but can reduce costs 10–60%

- Monthly fees are lower

- No deductibles or annual caps

3. Group Employer Plans

- Some employer-sponsored dental plans include implant coverage

- Lower cost due to group pricing

4. Medicare Advantage Plans (with dental)

- Some Advantage plans offer limited implant benefits

- Not included in Original Medicare

- Call the official Medicare.gov number at 1-800-MEDICARE to inquire about dental coverage options

What’s Not Covered (Hidden Exclusions)

- Pre-existing conditions (missing teeth before coverage began)

- Cosmetic add-ons (e.g., zirconia upgrades)

- Experimental treatments

- Implants for non-functional reasons (purely cosmetic)

How to Choose the Right Dental Implant Insurance in 2025

- Check the waiting period: Some plans make you wait 6–12 months before major work

- Review annual max limits: $1,000–$2,500 is typical

- Read exclusions: Pre-existing clauses are common

- Network dentists: Make sure implant specialists are in-network

Expert Tip: Combine Plans

If your primary dental insurance only partially covers implants, you can pair it with a discount plan or use an HSA/FSA to save on taxes.

The Future of Dental Implant Insurance in 2025

As dental technology advances, the landscape of dental implant insurance is evolving. With more individuals seeking dental implants, understanding how insurance can alleviate costs is increasingly significant. This insurance not only reduces financial burdens but also encourages better oral health. Let’s explore the future of dental implant insurance.

The Evolution of Coverage Options

Dental insurance providers are recognizing the growing demand for dental implants and expanding their coverage options. Key points include:

- Increased Awareness: More professionals are educating patients about implants, boosting demand.

- Insurance Adaptation: Insurers are offering more comprehensive plans that include dental implants.

- Cost Management: Increased competition may lead to more affordable options for patients.

Technological Advancements and Their Impact

Technology is influencing insurance policies in several ways:

- Telehealth Services: Virtual consultations allow for informed decisions regarding insurance.

- Data Analytics: Insurers use analytics to tailor policies for dental implants.

- Innovative Payment Models: New subscription services may offer flexible payment options.

The Role of Preventive Care

As preventive care gains focus, dental implant insurance may evolve to promote early intervention, leading to lower costs and incentives for regular check-ups. Overall, the future of dental implant insurance looks promising, with increased support for patients seeking optimal oral health.

FAQs

1. How do people afford dental implants?

People afford dental implants through financing options, payment plans, dental loans, or using Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

2. How much do dental implants cost in NH?

In New Hampshire, dental implants typically cost between $3,000 and $5,000 per implant, depending on the procedure and provider.

3. How to prove dental implants are medically necessary?

To prove medical necessity, your dentist must provide documentation showing that the implant is essential for oral health, such as difficulty eating or speech issues.

4. Will Delta Dental pay for implants

Delta Dental may cover dental implants if they are deemed medically necessary, but coverage depends on your plan and policy details.

Final Thoughts: Can Insurance Really Help You Save on Implants?

Yes—if you choose the right plan. With implant procedures often costing $6,000 or more, having insurance can save you thousands. But not all plans are created equal. Look for one with high annual max limits, short waiting periods, and transparent coverage on surgical procedures.

Call (833) 203-6742 now to compare dental implant insurance plans and see how much you could save or visit NewMedicare.com for more dental coverage options.